Until just a few short years ago, the only way to get financing was through banks or venture capital funds. This was fine for some businesses, but created a lot of unwanted power dynamics in the world of capital. For one, if you wanted to raise capital – your best bet was to move to a “startup hub” like San Francisco, Amsterdam or London. This is easier done for some than others.

Tokens and token sales

Then, somewhere around 2017 – an era of ICOs was born. Anyone, anywhere in the world was able to:

- Issue a token on blockchain

- Sell the token to investors

This opened the door to many teams from all around the world start raising capital in this new and interesting way. And a lot of people used (and abused) this system. The ICO craze of 2017 doesn’t have a good reputation, because it was littered with a lot of shady projects and a lot of outright scammers. However, this is the case with most emerging technologies and we’ve come a long way since then. After raising the capital, most teams opted to allowe investors to trade their token. And that’s where a large “centralizing” force for this type of capital raise was lurking – listing on an exchange. Centralized exchanges would often act in a predatory manner, requiring large upfront fees to list the token and use threats of delisting to get what they want from token issuers. A big question of transparency appeared – the centralized exchanges were caught faking trading volume, fixing prices, frontrunning orders, etc…

Decentralized Exchanges

However, at the tail end of 2018 – Uniswap launched. It was an “automated market maker” decentralized exchange. What this meant was that anyone was able to issue a token, sell it to investors and list on this “decentralized” exchange – fully transparently! This, in turn, led to another token craze just two years later at the end of 2020 and early 2021.

The market for tokens and token sales has matured a lot since then and now – a lot of high quality, mature projects are using blockchain to access capital and offer their tokens to investors.

Do it yourself

Now that we’ve covered the basics of selling tokens, what if you want to do it yourself? Look no further, in this article we’ll cover all the most important concepts of running your own token sale. Beyond this, we’ll create a token and list it on Uniswap! The best part? There is no coding knowledge required. If you have an idea and a community – this article is all you need to run a successful token sale.

The basics of token sales

In order to successfully run a token sale, you’ll need to have a good grip on the basics of tokens and token sales. So let’s go though it step by step.

Choosing the blockchain network

This article will cover launching the token on an “EVM” or Ethereum-like blockchain networks. Some of the more popular choices are:

- Ethereum – The biggest and most used smart contract blockchain. Most users, most capital available. However, it’s somewhat expensive and slow to use.

- Polygon – A more centralized, but faster and cheaper blockchain. Polygon is very developed and has a lot of capital and a lot of users.

- Binance Smart Chain – Very centralized, fast and cheap blockchain. It’s also quite developed with a strong user base and access to capital. Connected to the centralized crypto exchange – Binance.

- Avalanche C-Chain – Centralized, fast and cheap. Somewhat less developed and with less users, but a significant amount of activity is present.

- Aurora – A blockchain network with a focus on user friendliness. Reasonably decentralized, and pairing it with Aurora+ makes it very user friendly. Less user activity and locked capital available.

- Moonbeam – This is the nominal EVM blockchain for the Polkadot ecosystem. Good decentralization, cheap and fast. Low user activity.

Choosing the network is a very complicated process and this article won’t go deeply into it. This tutorial will be using the Polygon network due to quick transactions and availability of the Uniswap DEX.

Creating tokenomics

Tokenomics is a broad term covering several connected topics connected to the issuance of the token. Broadly we can think of tokenomics as follows:

Choosing the token type

The most common token type is ERC20 and many of its variants.

Fixed supply – The token has a fixed supply when it’s created. Nobody can create or destroy tokens.

Mintable – The token supply can be changed by the developers or some other entity (e.g. a DAO – Decentralized Autonomous Organization).

Choosing the initial token supply

How many tokens do you want to create at launch? This has mostly a psychological effect for traders. Good point to aim is between $0.1 and $5 for the initial sale price of the token.

Choosing the sale structure

How many rounds of sales do you want to have? Most tokens have multiple rounds at different prices. For example, you can have a private sale, pre-sale and public sale.

Private/seed sale – The private or seed sale usually has a lower price per token and is reserved for larger investors. These investors contribute earliest.

Presale – Presale has a higher price than private sale, but is preceding the public sale. It’s reserved for a broader audience, but still closed on an individual basis.

Public sale – The public sale is usually done through an intermediary called a “Launchpad”. You allocate a certain amount of tokens to the launchpad and then they sell it to their investors. Beyond using a launchpad, you can do the public sale yourself. This moves the requirement to find investors and generate initial “hype” yourself.

Creating the token distribution

The token distribution determined who gets how many tokens and when. Some common categories include:

Private/pre-sale investors – Good rule of thumb is to sell most of your tokens in private or pre-sale. Around 80% of the “sellable” supply.

Public sale investors – The public sale should be the most liquid and smallest round. Around 20% of the “sellable” supply.

Non-sellable supply – A lot of your token supply should not be sold on the market. It’s reserved for the team, advisors, next rounds and exchanges.

- Team – depending on the project, you’ll distribute anywhere from 10% – 30% of the supply to the team. Any more than that is generally considered too much.

- Advisors – for people helping you with the project, it’s good to reward them with tokens. Dedicate up to 5% of the supply for advisors.

- Exchanges – in order to list your token on exchanges (including decenteralized exchanges), you’ll need to send some of it to the exchange. Reserve up to 10% of the supply for exchanges.

- Follow-up rounds – you might want to sell additional tokens later down the line. Reserve some amount of tokens for this. There is no good rule for this, it’s very individual for projects.

Round size

Maybe the most important question of them all – how much are you raising? There really is no good guideline here, as token sale rounds can go from $500k to $2B – depending on the project.

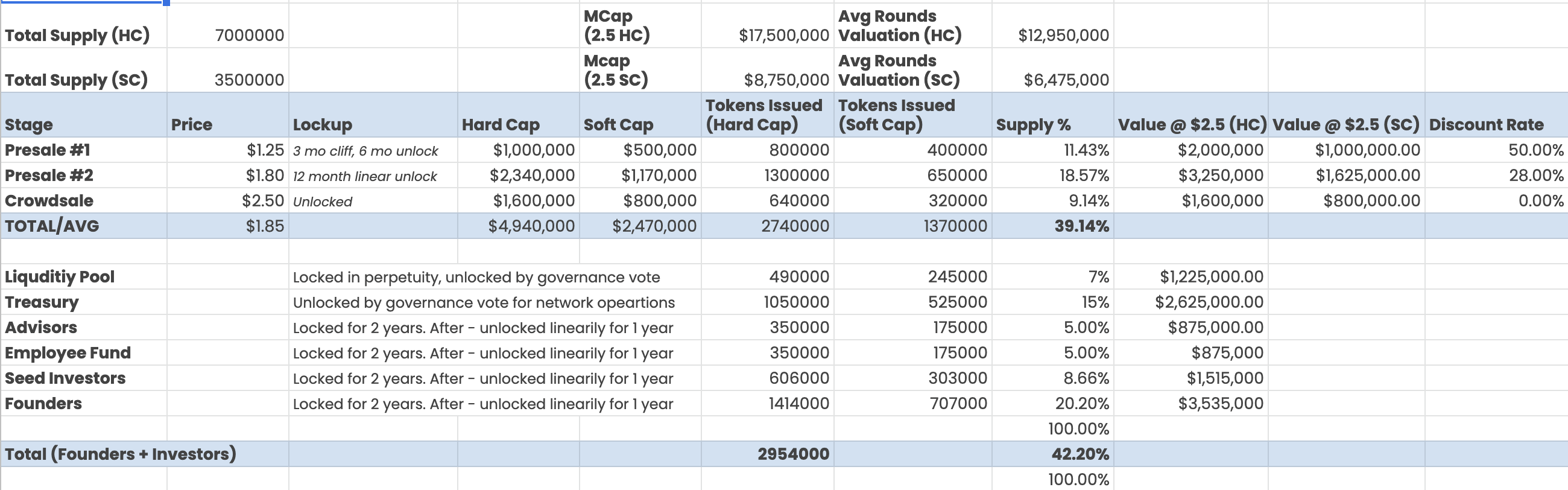

Here is one example of tokenomics.

Creating your own token

Once you have decided on the details of your token sale – Dev3 is the easiest way to launch your own token and list it on a decentralized exchange. Read the next article to learn – how to launch your token and list it on a decentralized exchange.